Affording Senior Care in the U.S.

Key Takeaways

Alaska and Massachusetts are the most expensive states for senior care; Alabama and Texas are the least.

Semi-private and private nursing home facilities in Alaska cost 298% and 249% more than the national median, respectively.

Nearly 50% of older adults feel they are not financially prepared for future senior care.

43% of older adults plan to rely on family or friends for assistance if they cannot afford senior care.

The Cost of Caring

Let’s face it—everything is expensive right now. But rising costs and an uncertain economy can feel especially stressful for those over the age of 55 who are starting to prepare for senior care. Which states have the highest senior care costs, and how are older adults preparing for the future?

To find out the most and least expensive states for senior care, we collected cost data from all 50 states across six categories and ranked the states based on our findings. We also spoke with 1,025 older adults about their financial plans and fears regarding the cost of senior care.

Senior Care Costs Across the Country

The number of older adults is growing faster than ever as baby boomers continue to age. Some states are ready to welcome seniors with open arms, while others have significant barriers to overcome. Let’s take a look at which states are the most expensive for senior care.

Click here to view the interactive table in a separate window.

With exorbitant nursing home costs, Alaska emerged as the most expensive state for senior care. An expensive place to live in general, Alaska’s cost of living is 30% higher than the national average. Still, the state’s average income to cost of care ratio was the worst in the nation, emphasizing the challenges seniors and their families face in affording necessary care.

Following Alaska, Massachusetts and Maine were the second and third most expensive states with some of the worst income-to-cost ratio rankings. In seventh place, Rhode Island had the highest costs for community and assisted living, which can be crucial options for seniors seeking a balance between independence and supportive care.

On the opposite end of the list, Alabama and Texas offered abundant care options and comparatively lower costs, making them the least expensive states for senior care. Along with these states, many of the 10 most affordable places for senior care were in the southern part of the country, including Georgia, Louisiana, Mississippi, South Carolina, Arkansas, and North Carolina. Looks like Southern hospitality extends to seniors and young’uns alike.

Most and Least Expensive Senior Care Services

States like Alaska highlight the immensely high costs of senior care in general, but what about the specific costs of individual care services? Let’s look at the state-level costs for senior care services and how they compare to the national median.

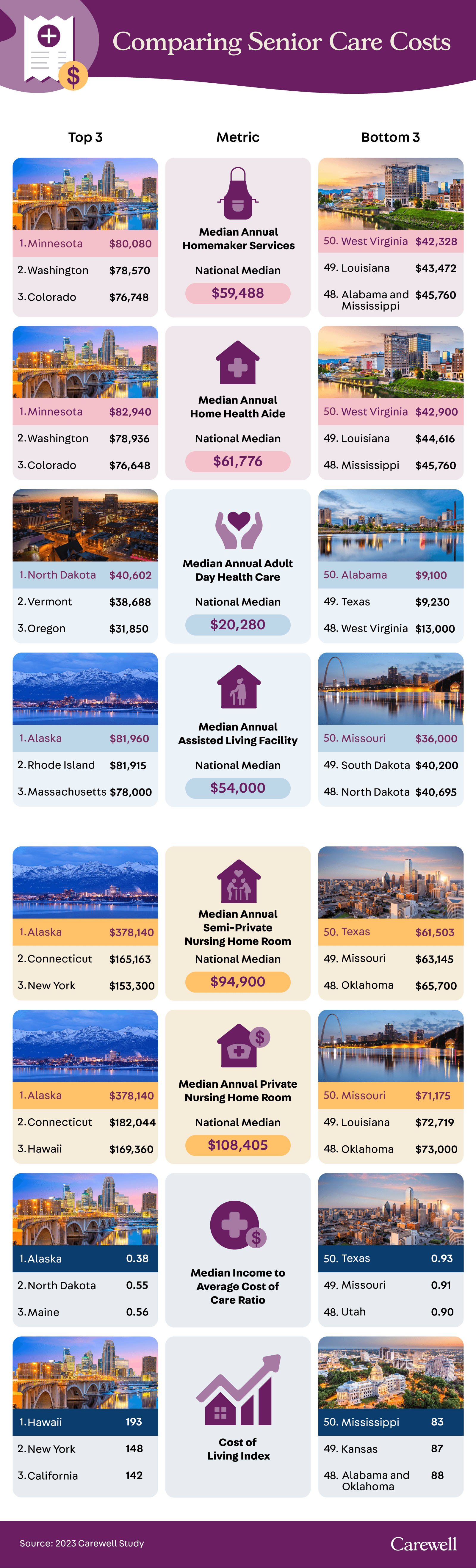

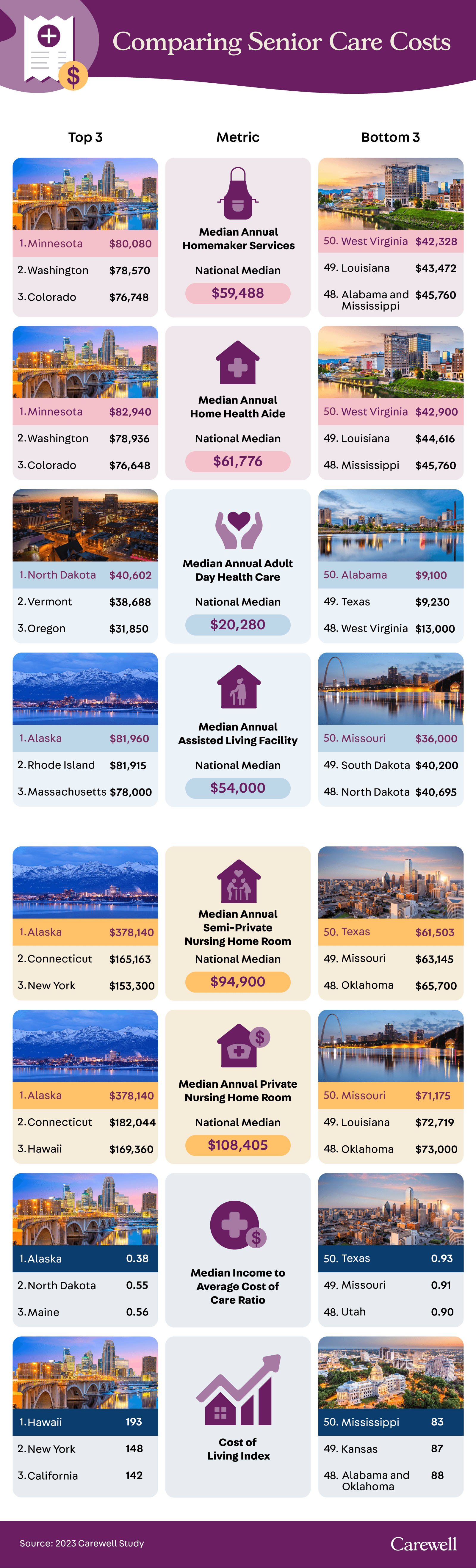

Homemaker services and home health aides allow seniors to receive care in the comfort of their homes. Minnesota, Washington, and Colorado were the three most expensive states for homemaker services and home health aids, with costs ranging from $17,000 to $22,000 over the national median. West Virginia, Louisiana, and Mississippi were the least expensive states for these services, with costs up to $18,800 below the national median. Alabama was also among the least expensive states for homemaker services.

Regarding assisted living facilities and nursing home costs, Alaska had the highest costs compared to the national average. Assisted living costs in Alaska were almost $28,000 over the national median. Missouri had the least expensive median assisted living costs, at $36,000 per year. Meanwhile, costs for semi-private and private nursing home rooms in Alaska were an astounding $283,000 and $270,000 over the national median—a difference greater than the annual cost of all three least expensive states for nursing home rooms combined.

Alaska also had the worst median income-to-cost care ratio, with the average income only covering 38% of care costs. In contrast, Texas had the best income-to-cost care ratio, with the average income covering 93% of care costs. Missouri was a close second with a 91% ratio, and Utah was just behind at 90%.

Texas also had the most affordable semi-private nursing home rooms at over $33,000 below the national median. Missouri came second in that category at just $2,000 more per year. Missouri also led the way for affordable private nursing home rooms at $37,000 below the national median.

Rising Costs of Senior Care

Let’s take a closer look at the states where senior care costs are higher than the national average.

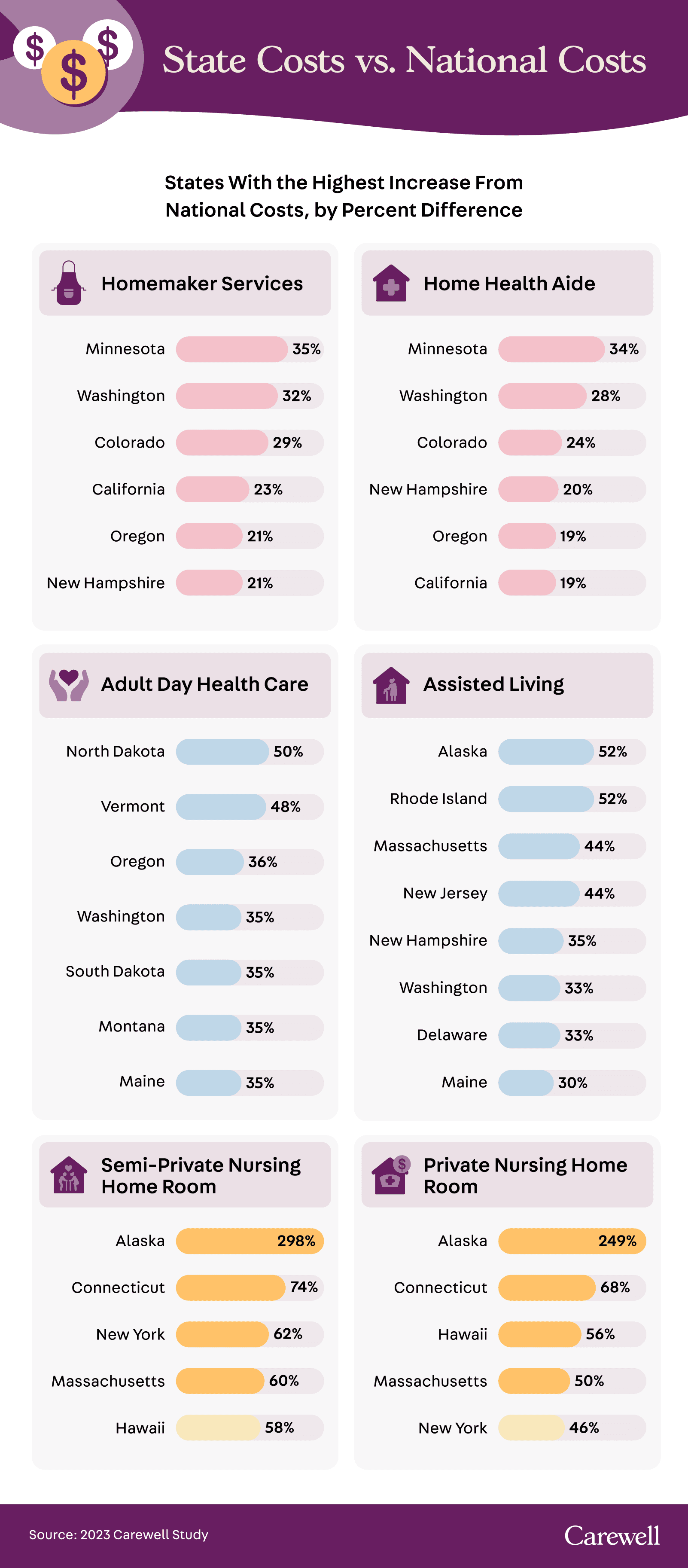

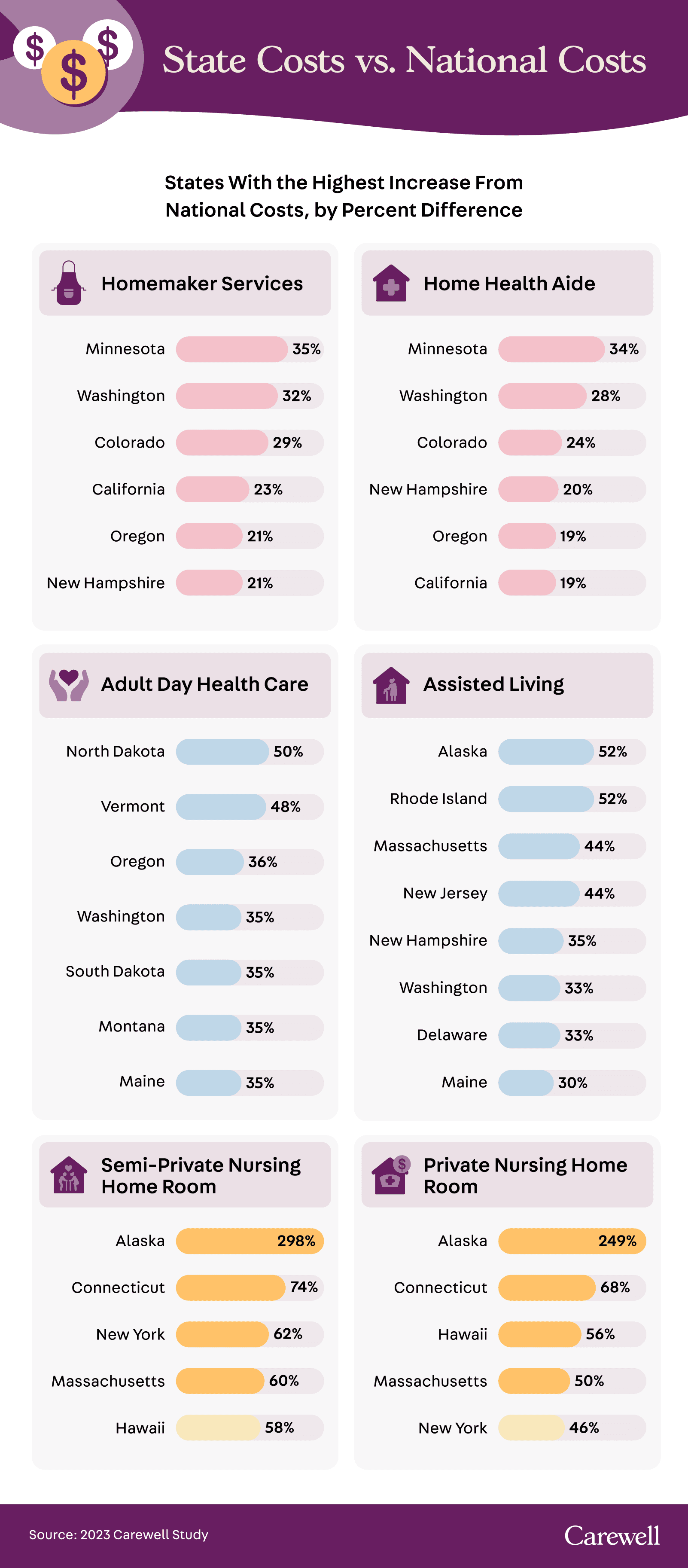

Regarding homemaker services and home health aides, the same six states had the largest percentage increase compared to national averages across both categories. Minnesota had the largest difference for both services at a 35% and 34% increase, respectively. Washington and Colorado ranked second and third, followed by California, Oregon, and New Hampshire in various orders.

If receiving in-home care is a priority for you and your loved ones, you might want to avoid those six expensive states. We found Missouri, Louisiana, and Mississippi were more affordable alternatives, costing 31%, 28%, and 26% less than the national median.

As for part-time care, North Dakota demonstrated the most significant cost disparity for adult day health care at 50% above the national median, followed by Vermont at 48% and Oregon at 36%. For those considering assisted living facilities, Alaska and Rhode Island cost 52% above the national median, followed by Massachusetts and New Jersey, which were 44% higher.

However, the most shocking gap in state versus national costs was Alaska’s costs for semi-private and private nursing home rooms at an astounding 298% and 249% over the national median, respectively. Clearly, Alaska is not an ideal location for affordable senior care.

Connecticut was the second most expensive state for nursing home rooms at 74% and 68% above the national median—still significantly less than Alaska. Missouri and Louisiana were the cheapest states for a private nursing home room, costing 34% and 33% less than the national median.

Financial Fears of Older Americans

Given the exorbitant costs of senior care services in many states, older Americans may be rightfully fearful for their futures. We surveyed 1,025 Americans over the age of 55 to get a better understanding of their financial fears and plans for senior care.

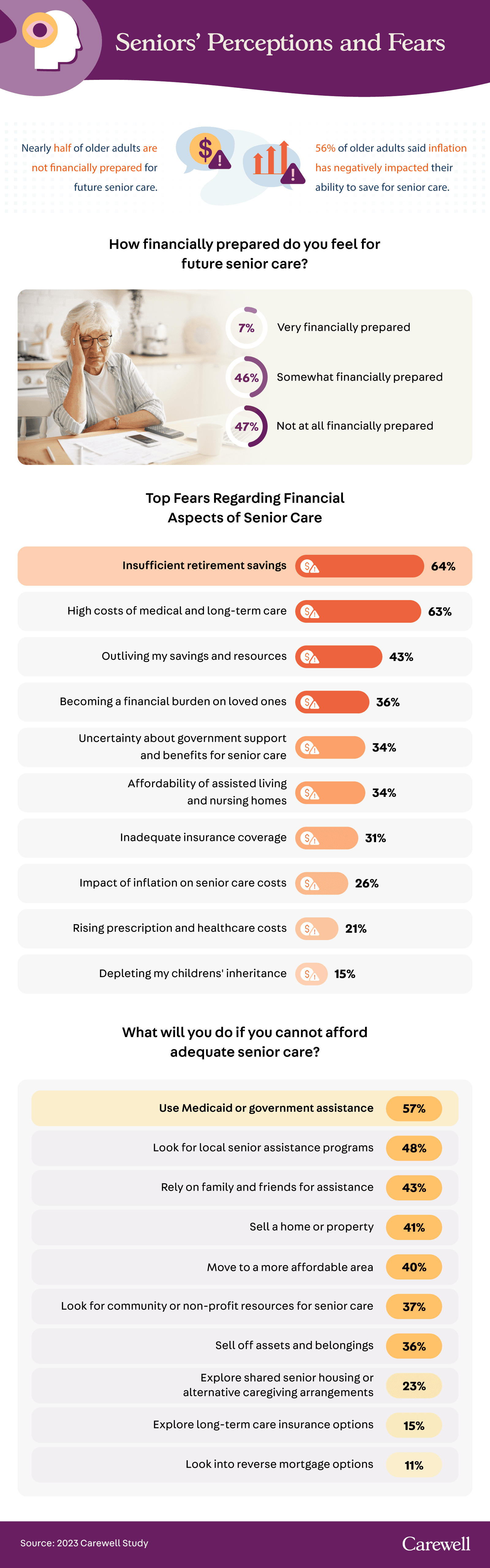

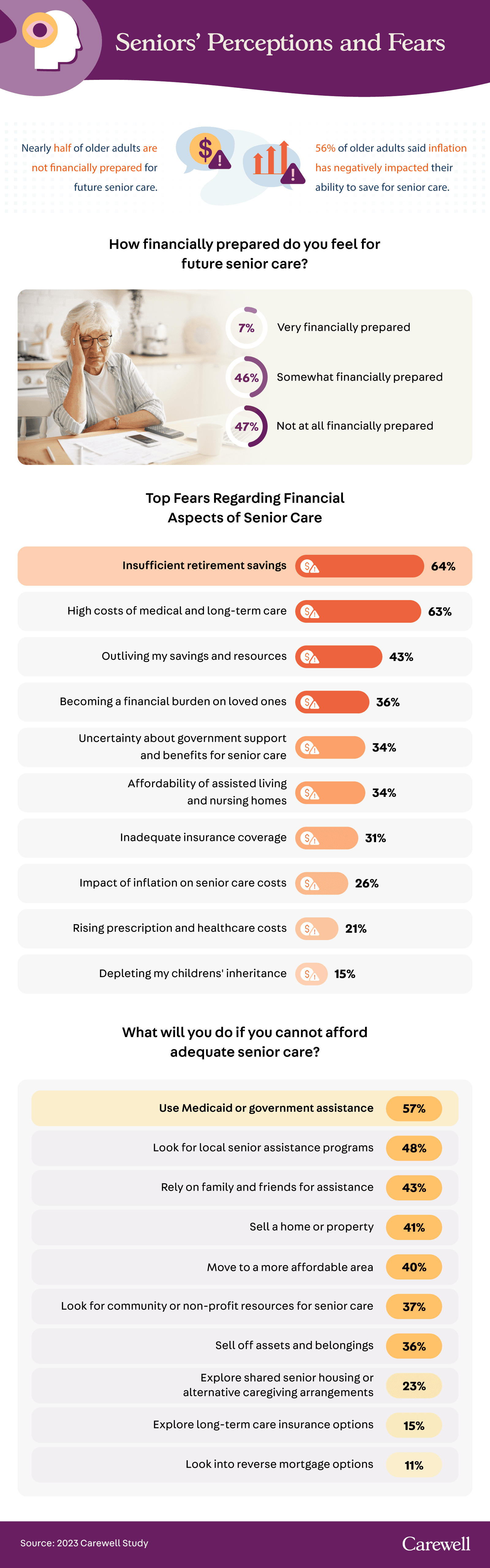

Almost 50% of older adults said they are not at all financially prepared for future senior care, and only 7% felt very financially prepared. More specifically, 64% of older adults feared not having sufficient retirement savings, and 63% feared high medical and long-term care costs. These sobering statistics highlight the need for more affordable senior care nationwide and the importance of prioritizing humane and quality senior care as the country’s population ages.

To help mitigate these fears, many older adults have alternative plans in mind should they be unable to afford adequate senior care on their own. Medicaid and government assistance emerged as the most popular backup plan, with 57% of older adults considering it a potential solution. Another 48% said they would look for local senior assistance plans.

Notably, 43% of older adults would rely on family or friends if unable to afford senior care. Given that 36% expressed fear of becoming a financial burden on loved ones, this statistic shows the desperation many older adults feel as they consider the high costs of care.

The Realities of Senior Care

Senior care costs are significantly high, with only a few states offering relief. As the U.S. population ages and baby boomers enter their senior care years, the country needs to prioritize quality care and cost assistance for seniors and their families. From being cared for by a loved one, receiving professional in-home care, or living full-time at a nursing home, older adults should be able to feel confident about their future care. Promoting financial assistance initiatives, community programs, and support for senior care facility workers can help ensure a safe, comfortable, and affordable future for our loved ones.

Methodology

We collected state-level cost data for six different types of senior care, 2021 median income data for people aged 65+, and cost of living data to create a unique metaranking and determine the most expensive states for senior care. The following variables were used in the ranking:

Average annual in-home care costs (25%)

Average annual assisted living and community care costs (25%)

Median assisted living

Median adult day care

Average annual nursing home costs (25%)

Median semi-private room

Median private room

Income to cost of care ratio (15%)

Cost of living index (10%)

We also surveyed 1,025 U.S. adults aged 55+ to explore their financial plans and fears regarding senior care.

About Carewell

Carewell is a leading provider of high-quality home health products and caregiving supplies, dedicated to supporting individuals and families in their caregiving journey. With a wide range of essential products, including incontinence supplies, mobility aids, wound care, and more, Carewell strives to improve the well-being and quality of life for both caregivers and their loved ones. By offering reliable and convenient access to top-notch caregiving supplies, Carewell aims to empower caregivers and enhance the comfort, safety, and independence of those in need.

Fair Use Statement

Are you concerned about the costs of senior care in the U.S.? Feel free to share this article with others for noncommercial purposes only; you must provide a link back to this page so readers can access our full findings and methodology.