Finding the perfect place to retire is a big decision that involves many important factors, such as cost of living, proximity to family, and lifestyle preferences. At Carewell, we surveyed over 1,000 Americans aged 45 and older to understand their housing choices and preferences. This article reveals where retirees can find the best homes for sale or rent in 55+ communities, their preferred lifestyles, and their dream retirement destinations. Our findings offer valuable information to help you plan the ideal retirement for your needs.

Key Takeaways

The most homes for sale in 55+ communities are in Mesa, AZ; St. Petersburg, FL; and Port St. Lucie, FL.

Dallas, TX, has the most expensive homes in 55+ communities (averaging $1.18 million). Glendale, AZ has the cheapest ($124K).

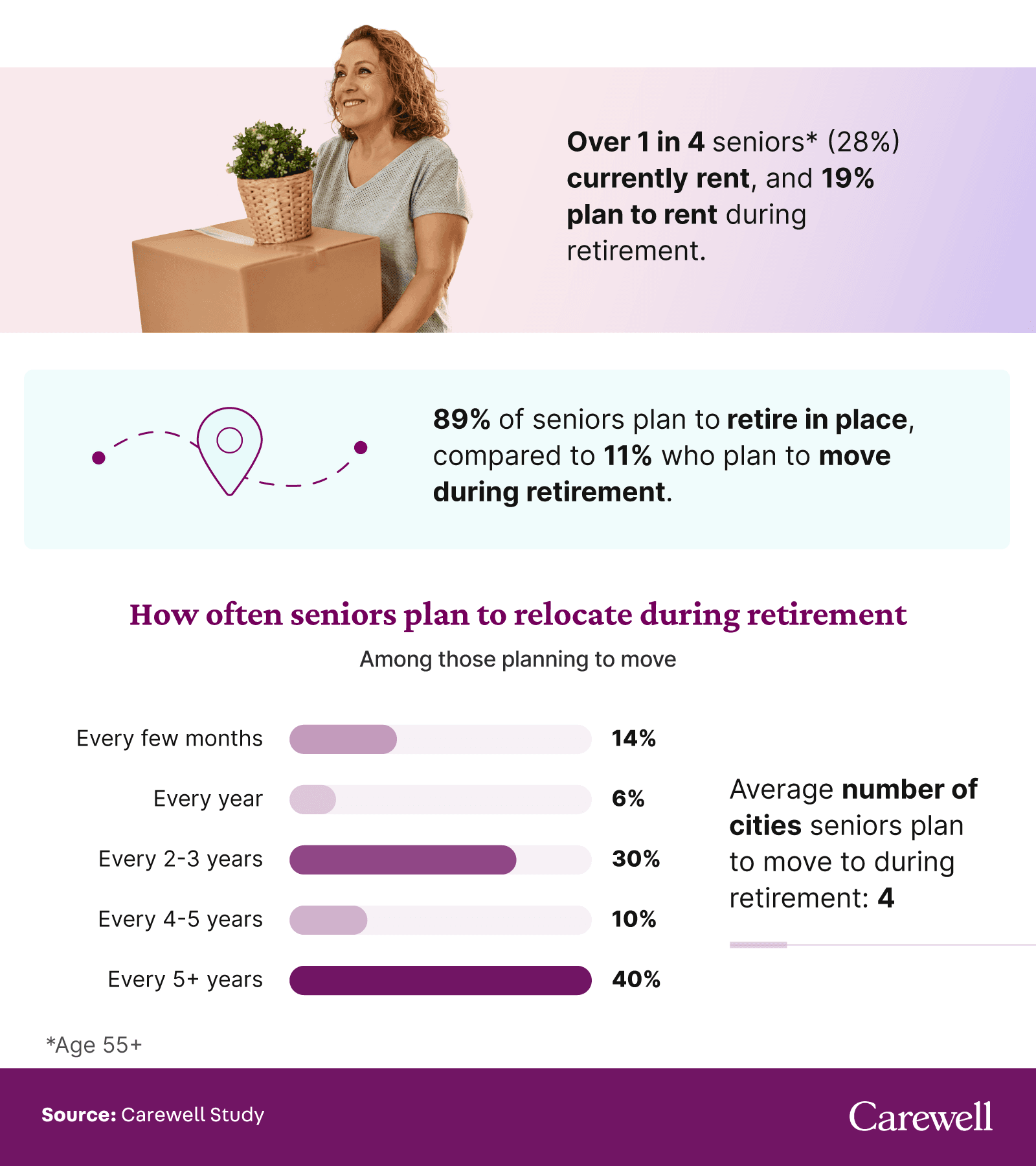

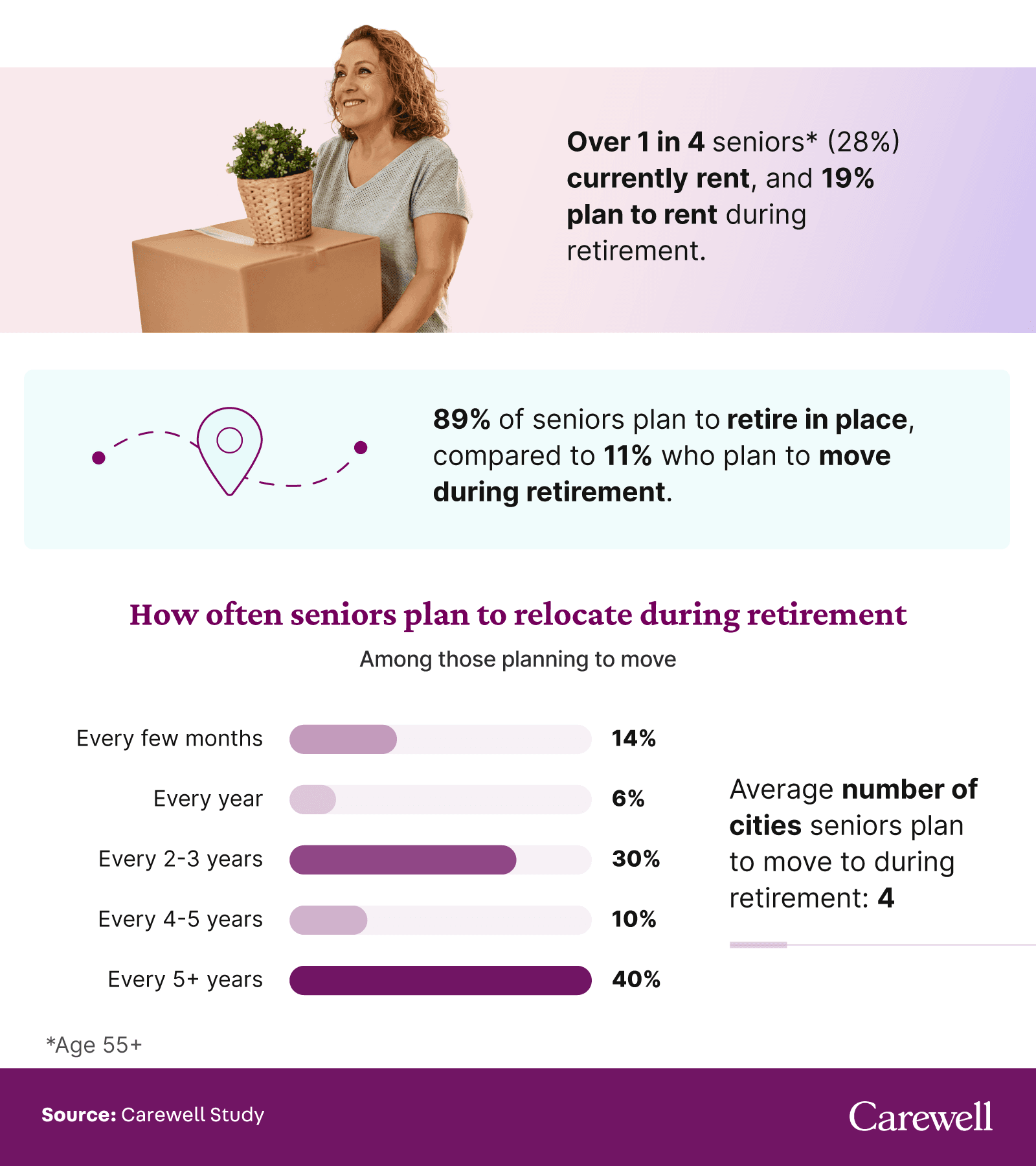

Over 1 in 4 seniors aged 55+ (28%) currently rent their homes, and 19% plan to do so when they retire.

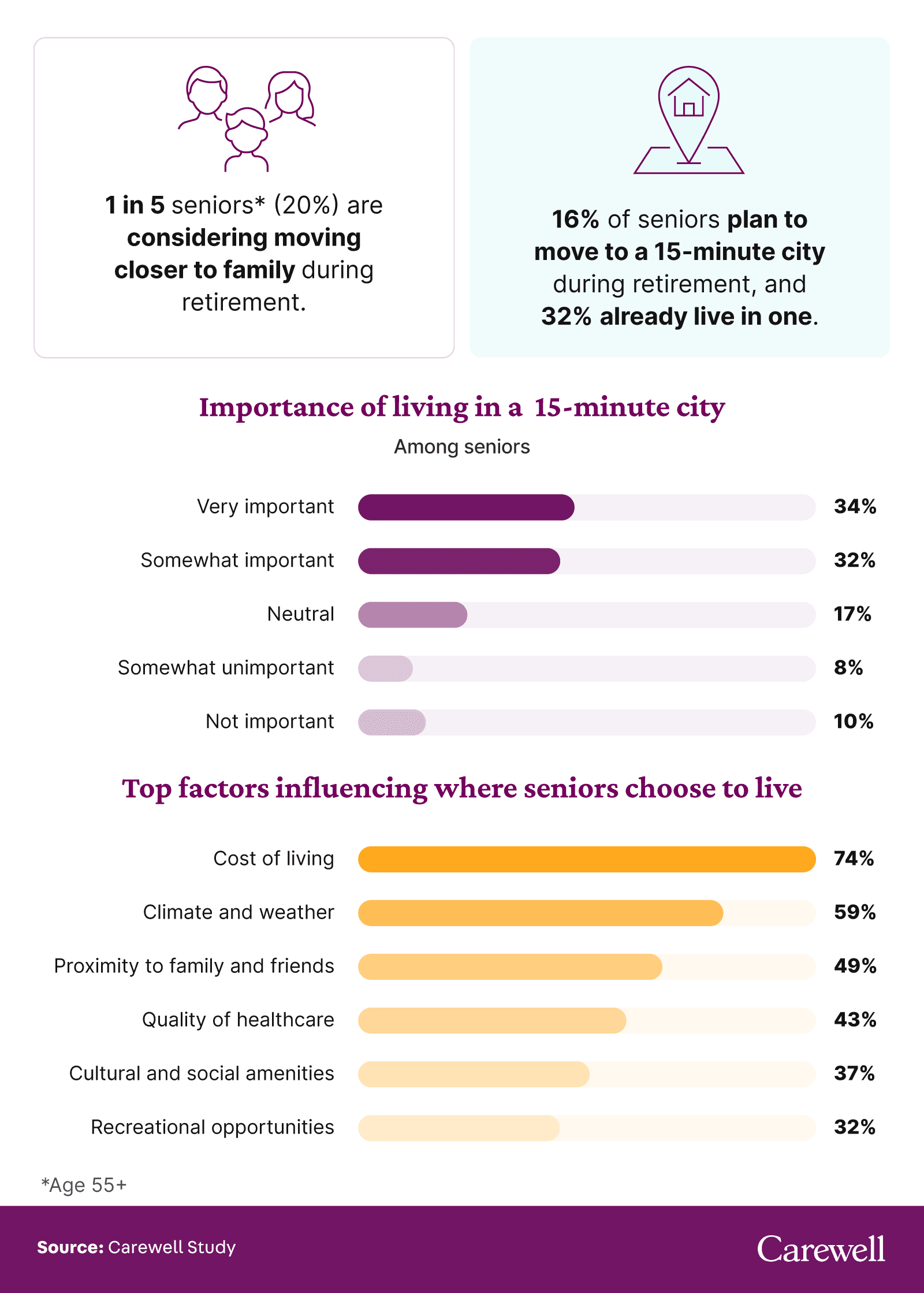

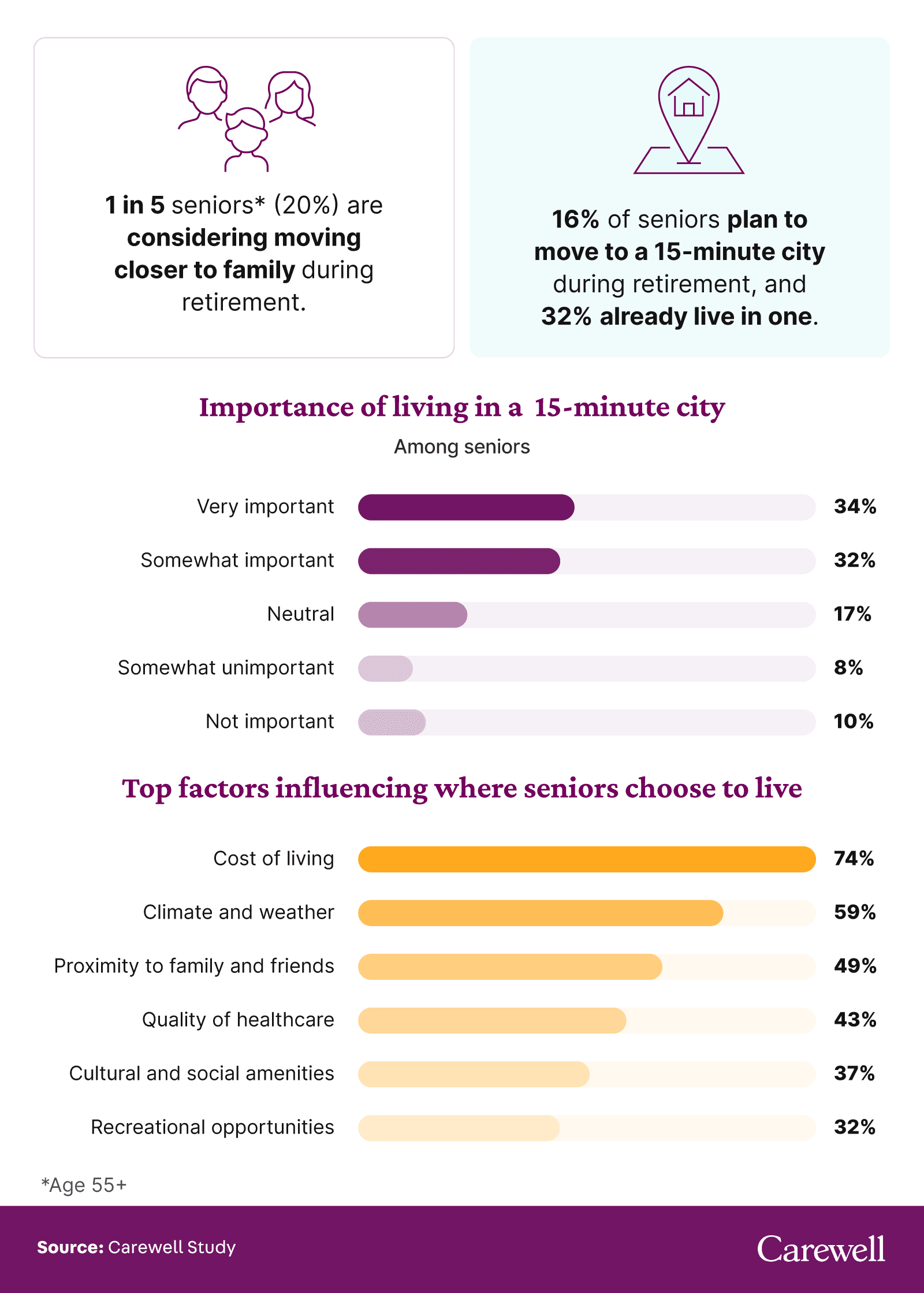

16% of seniors plan to move to a 15-minute city during retirement, and 32% already live in one.

Cost of living is the most important factor for seniors when choosing where to live (74%), followed by climate and weather.

Top Locations for 55+ Communities in 2024

Choosing the perfect place to retire involves many factors, from affordability to the weather. This section explores where seniors can find homes for sale in 55+ communities: neighborhoods designed for active adults aged 55 and older. These communities offer amenities and social opportunities tailored to older adults’ needs.

Looking for details about a specific city? Our interactive chart below allows you to easily search and sort info we gathered from Realtor.com. It also shows which cities have the most 55+ homes for sale and how much they cost, on average.

Mesa, AZ, St. Petersburg, FL, and Port St. Lucie, FL, were the top locations with the most homes for sale in 55+ communities. Dallas, TX, topped the list for the most expensive homes in these communities, with an average home price of $1,183,810. In contrast, Glendale, AZ, offered the most affordable options, with homes averaging just over $124,000.

The variation in the number of homes and their prices across different states can be attributed to several factors. States like Arizona and Florida, known for their warm climates and lower cost of living (both only slightly above the national average), tend to attract more retirees. States with older populations also typically have more 55+ communities to meet the housing needs of their residents.

Retirees’ Renting and Relocation Trends

Understanding where and how older adults choose to live can help others make informed retirement planning decisions. Let’s look at some trends in renting and relocation among seniors aged 55 and older.

Over 1 in 4 seniors (28%) reported that they currently rent their homes, and 19% have planned to rent when they retire. Renting can offer flexibility and reduce the burden of home maintenance, making it an attractive option for people who may be less able to deal with things like repairs and yard work. It can also be a good choice for those who may need to relocate to a retirement or assisted living community on short notice.

A majority of seniors (89%) said they plan to retire in place, indicating a strong preference for staying in familiar surroundings. Another 11% said they’re considering relocating during their retirement years. Among them, more than 1 in 10 (14%) mentioned that they plan to move as often as every few months in retirement. This could suggest a desire for a more mobile and adventurous lifestyle later in life.

Dream Retirement Destinations

If you could retire anywhere, where would you go? Many personal and practical considerations can influence the choice of place to retire. This section explores seniors’ preferences and top dream retirement destinations.

Being close to family is important to many seniors, but not all of them: Only 20% of those we surveyed were considering moving closer to their family during retirement. Those not planning to do so may already live close to their families or value other quality-of-life factors more.

Some seniors (16%) wanted to live in a 15-minute city when they retire, where all essential services and amenities are within a 15-minute walk or bike ride. Another 32% were already living in one. The convenience of these cities offers a quality of life that appeals to people of all ages, but retirees may find it uniquely helpful. It could even offer seniors cognitive health benefits.

When choosing where to live, the cost of living was the most important factor for 74% of seniors, followed by climate and weather. Seniors’ top three dream retirement cities were San Diego, Honolulu, and New York City. The first two are known for their appealing climates, while NYC is famous for its cultural attractions, diverse neighborhoods, and vibrant urban life. Internationally, Paris topped the list as the most desired city for retirement.

Preferences for the type of location varied, though. Here’s how these three ranked:

Suburban: Preferred by 63% of seniors, these areas typically offer a blend of urban amenities and residential tranquility.

Urban: Chosen by 20% of seniors, these areas are characterized by dense population, diverse cultures, and close proximity to services and entertainment.

Rural: Selected by 12% of seniors, these areas are often quieter, less populated, and closer to nature.

The remaining 5% had no preference, indicating flexibility in their ideal geographic retirement setting. These preferences reflect the diverse lifestyles and priorities among retirees. Our findings emphasize the importance of a tailored approach to choosing a retirement destination.

Planning for the Best Retirement Life

Planning for retirement involves balancing financial considerations with lifestyle desires. Our survey revealed that affordability, climate, and proximity to family are top priorities for many seniors. Whether it’s the allure of suburban tranquility, the dynamic life of urban settings, or the peace of rural areas, retirees have diverse preferences that will shape their retirement decisions. We hope these trends give you insights that help you plan for a comfortable and fulfilling retirement.

Methodology

We surveyed 1,001 Americans 45 years of age and older to explore retirement plans, grouping and labeling those age 55+ as seniors. Of the respondents, 47% were seniors, and 53% were aged 45-54.

We also analyzed Realtor.com data using the 55+ filter to explore for-sale listings in 55+ communities. Only cities with 5 or more listings were included. Listings from neighboring cities may have been included in the radius for each location.

About Carewell

Caregivers are unsung heroes who deserve the best support and resources available. As a family-owned business, we at Carewell pour our hearts into curating a selection of high-quality home health products and providing the caregiving guidance you need. We’re here with a helping hand, a listening ear, and the tools to support your well-being and success.

Fair Use Statement

We allow the redistribution of these findings solely for noncommercial purposes, provided you include a hyperlink back to this page.